free crypto tax calculator australia reddit

Cryptocurrency Tax Calculator. Online Crypto Tax Calculator with support for over 400 integrations.

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Calculate and report your crypto tax for free now.

. It is now October 31 and BTC price is around 6000 USD. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. ATO crypto tax warning letters.

You will only start to pay Income Tax when your hit 18200 in total income per year. Then lets say they psychologically didnt want to sell after the market crashed. See our 500 reviews on.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Crypto tax software and cointracking calculator. 49 for all financial years.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space. Miningstaking Income report. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance.

Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. An email received by Australian user on reddit. Crypto taxpayers can use the libra tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000.

Buy 033 BTC Dec 22 2018 4000 USD. Straightforward UI which you get your crypto taxes done in seconds at no cost. Sell 03 BTC Dec 1 2018 3000 USD.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Free crypto tax calculator australia reddit Saturday April 2 2022 Edit. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. We use cointracking for our clients needs australian crypto accountant First 200 trades are free and would work well for OP.

Our prices start well under 750 obviously every client is different but around 400 including the cost of software for first couple exchanges first 200 trades is a good indication. ATO Tax Reports in Under 10 mins. This service enables users to quickly generate accurate and.

Security Tokens Will Be Coming Soon To An Exchange Near You Security Token Token Security Pin By Rob Kidd On Crypto Digital Currencies Blockchain Buy Bitcoin Bitcoin Price Bitcoin Value Share this. Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to cryptocurrency tax too. Tax-Loss Harvesting With A Crypto Tax Calculator.

How is crypto tax calculated in Australia. Then I released it on Reddit for free. On March 11 2020 it was reported that the Australian Taxation Office ATO had started sending tax notices to 350000 Australians who had cryptocurrency transactions.

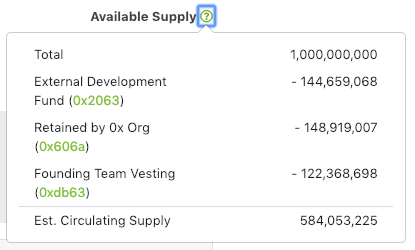

Redirecting to httpswwwkoinlyio 308. Not only can we handle 400 exchanges and wallets but we also work with all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. I tried Googling and using the Reddit search but surprisingly there arent a lot of posts on this. Buy 021 BTC Dec 10 2018 3000 USD.

Cryptotradertax is one of the best online cryptocurrency tax calculator. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an Aussie-made crypto tax solution.

Sell 021 BTC Dec 17 2018 4300 USD. Has the community figured out what the established non-scam tax calculator website we should all be using. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Support for all exchanges and 10000 cryptocurrencies. Likewise does anyone know the easiest amount to report even if its a slight overestimation.

Bitcointaxer Org Open Source Crypto Tax Calculator And Portfolio Tracker R Cryptotax

Understanding Cryptotax Calculator Reports R Bitcoinaus

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Best Cryptocurrency Tax Calculator At Breaking News

How To Calculate Crypto Taxes Koinly

![]()

Best Cryptocurrency Tax Calculator At Breaking News

40 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader 239 40 Ozbargain

Crypto Staking Taxes Ultimate Guide Koinly

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

I Created A Free Tax Calculator And Subtly Promote Nano In It Please Read R Nanocurrency

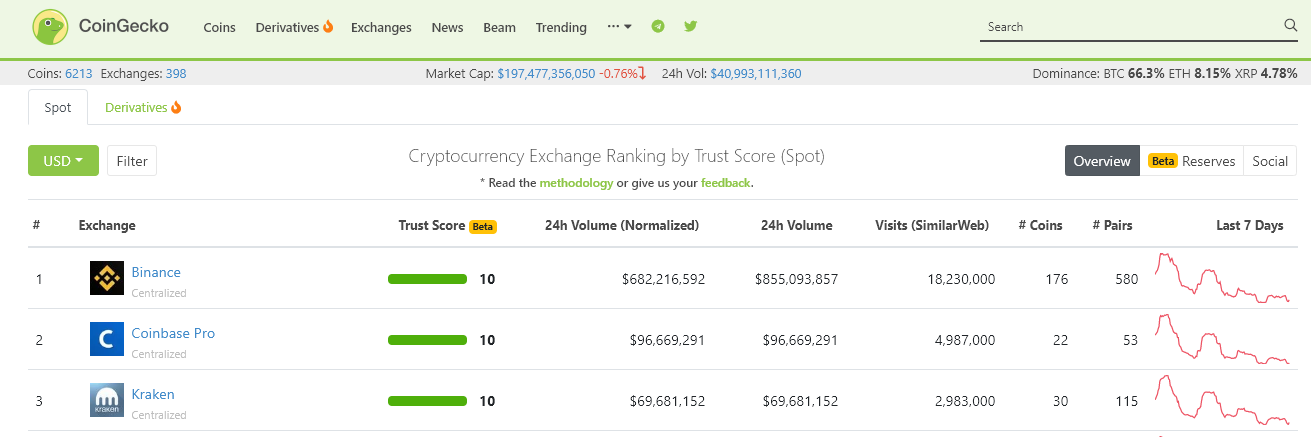

3 Steps To Calculate Binance Taxes 2022 Updated

Dollar Cost Average Calculator Returns Nerd Counter

Dollar Cost Average Calculator Returns Nerd Counter

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds